Concentrated Stock

Quarterly Update

Q4 2022

Highlights

Inflation reports show continued progress after the Fed increased rates by 1.25% last quarterOur stock scoring models modestly reduced exposure to the energy sector due to valuationsThe higher interest rate environment is creating opportunities in the options marketPortfolio Insights: why higher interest rates make options solutions more attractive

Senior Vice President

Portfolio Management

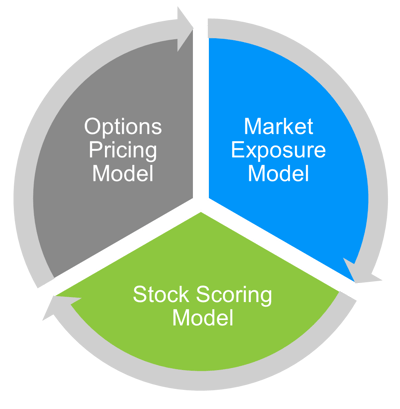

Market Exposure Model

Stock Scoring Model

Options Pricing Model

What Effect do Higher Interest Rates Have on Options?

Assuming a very simplistic model and holding all other variables constant, higher interest rates may present attractive opportunities for options investment solutions. Covered call strategies, which entail selling call options against stock positions to generate premiums, generally produce greater yields since interest rates and option prices are directly related. Higher interest rates bring about increases in the risk-free rate, which generally leads to expected increases in stock market returns.

Another way to look at this is that, for the same level of risk (as measured by delta1), covered calls permit better upside participation now than in years with lower rates. Upside participation is calculated as the percent difference in the option strike price and the stock price at the time the covered call is initiated. For example, a stock priced at $100 with a $110 option strike price would allow for 10% upside.

The time series graph below shows the relationship between the Fed Funds target rate, the implied (or expected) target rate, and upside for MSFT call options2. As expectations for interest rate hikes began to grow, even before the FOMC began to raise rates, the upside limit on MSFT covered calls increased.

The important takeaway is that right now, clients can capture more of a stock’s potential price increase with the same risk tolerance.

In summary, the current economic setting can be very beneficial for option strategies. In the following section, we discuss why.

Portfolio Insights: Why Higher Interest Rates Make Options Solutions More Attractive

Markets have priced in a near certainty of recession this year while stocks continue to experience bouts of volatility. One way of adding value to portfolios is through covered call writing.

NorthCoast’s Covered Call strategy, as mentioned above, involves selling call options against concentrated stock positions. Currently, a MSFT covered call is estimated to produce almost 6.3% in annualized premium while still maintaining 13.9% of upside potential.

By way of comparison, a covered call with similar duration initiated one year prior would have yielded only 5.5% annualized premium with 11.4% upside.

Another way of looking at this is that, keeping the annualized premium constant at 5.5%, today’s market would impute 4% additional upside.

On the other hand, keeping upside constant at 11.4% would mean 2% additional annualized premium.

Overall, both yield and upside look more favorable for covered calls, and this is expected to remain until the Fed starts lowering rates.

Interested in how Concentrated Stock Triple Play may help your portfolio?

Contact your NorthCoast advisor or email us at info@northcoastam.com.