Concentrated Stock

Quarterly Update

Q4 2023

Highlights

- Equity markets ended the year at a high as strong GDP growth, improving inflation data, and anticipated rate cuts fueled optimism that the US will likely avoid a recession

- Our stock scoring models incorporated higher sentiment as consumer confidence significantly rebounded in December and January

- A surge in options trading, especially 0DTE options (options that expire the same day they are traded), is setting record trading volume and adding liquidity to the market

- A Case Study on Pfizer: The Risks of Holding a Concentrated Position and the NorthCoast Approach

Senior Vice President

Portfolio Management

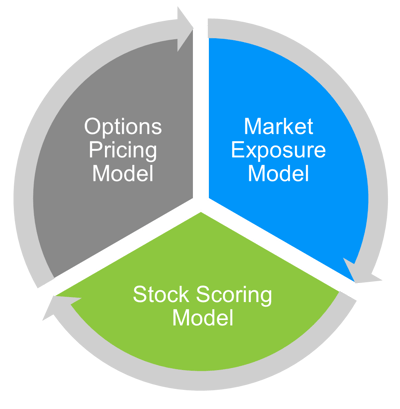

Market Exposure Model

Although recession fears have decreased considerably these days, we expect global growth to slow to below-potential this year. Our equity market outlook remains cautious given the continuing negative impact of high interest rates, the fading tailwinds from consumer support, rich equity multiples, and lingering geopolitical concerns. With this backdrop, we maintain a cautious allocation to equities and keep our U.S. equity exposure at 43%.

Stock Scoring Model

However, the models underestimated how much more semiconductor manufacturer Advanced Micro Devices (AMD) could rally after a strong H1 2023, which delivered 31% of excess returns in the fourth quarter alone. Due in part to rate cut expectations, our score on JPMorgan Chase (JPM) was neutral but the company had strong earnings, beating consensus estimates by 11%.

Options Pricing Model

Is the US Economy in for a Soft Landing?

The Federal Reserve voted in December to keep its key interest rate at 5.25% to 5.5% but appears to be penciling in at least three rate cuts this year. The FOMC explained that inflation has eased over the past year but that prices remain elevated. Perhaps reassuring committee members was that GDP grew 2.6% in 2023, and unemployment held steady at 3.7%.

Markets seem to be optimistic that the economy will avoid a recession, further fueling stock performance. Despite the strength of equity markets and the possibility of a soft landing, risk remains with concentrated positions. We can look at one of the oldest, currently operating companies as an example.

Pfizer Inc.

Pfizer1 (PFE) is one of the world’s best-known pharmaceutical firms, which became a publicly traded company on June 22, 1942, nearly a century after its founding. Due in large part to business and economic conditions2, PFE has pulled back from its highs in 1999. At its low point on March 2, 2009, amid the global financial crisis, the stock had lost almost 76% of its high point value. In 2020, the company was dropped from the Dow Jones Industrial Average index.

During the following years, shares climbed once again, but exploded during the height of the COVID-19 pandemic in 2021. PFE was one of three main companies selected by the US government to manufacture and distribute the COVID-19 vaccine. Shares reached an all-time high on December 16, 2021, having jumped 66% in that year alone.

Despite the strong rebound, as COVID cases worldwide dropped, so too did vaccine shipments. The stock ended 2023 down 53% from its COVID-era highs.

A Case Study on Pfizer: The Risks of Holding a Concentrated Position and the NorthCoast Approach

Due to recent equity performance, more clients may find themselves overexposed to a single stock. This is risky because a significant amount is tied up in one company’s prospects. NorthCoast’s actively managed covered call strategy can help clients strategically and incrementally sell down portions of concentrated positions to help mitigate single-stock risk.

Some of the risks of a concentrated equity position are corporate scandal, bankruptcy, volatility, drawdown, or that the dividend could disappear. Of course, even diversified portfolios have these concerns, but an assumption is that a diversified portfolio spreads these risks across many positions.

A covered call strategy involves selling a call option against a concentrated position while generating option premiums and allowing for some upside (see article “How a Covered Call Strategy Can Add Value”). How does this apply to Pfizer? The below chart illustrates various covered calls written for a client with a sizeable position in the stock.

.

According to our stock scoring model, which relies on data analysis, PFE had a negative long-term outlook. Therefore, we utilized strike prices that maximized premium collection. Many of the covered calls expired out-of-the-money (OTM), therefore, the client pocketed the premiums with the possibility of using the cash to cover taxes from liquidating stock. But a handful of calls expired slightly in-the-money (ITM), which still gave the client the opportunity to tax-efficiently sell down stock by offsetting PFE long-term gains against option losses (see article “Managing and Liquidating a Concentrated Stock Position Tax-Efficiently Over Time”). Clients can potentially diversify their portfolios with the net cash proceeds to help reduce the idiosyncratic risks.

In the example, our client reduced their PFE exposure by 37% over the past four years. The graph illustrates how diversifying a concentrated PFE position can partially offset losses during a selloff and produce a higher value portfolio.

This table compares the returns of a PFE Only portfolio versus those of a Diversified Portfolio.

While this case study is an illustration to show the benefits of a covered call strategy, a diversified portfolio does not guarantee lower risk or higher returns. But for many clients, taking a disciplined approach to selling stock at attractive prices and in a tax-efficient manner is a prudent choice.

Interested in how Concentrated Stock Triple Play may help your portfolio?

Contact your NorthCoast advisor or email us at info@northcoastam.com.