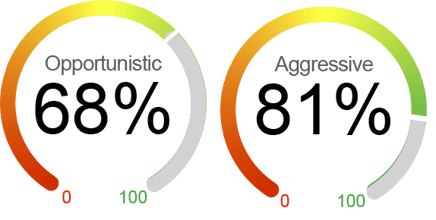

Current Equity Exposure

We employ two distinctive dynamic market exposure models in our strategies: one tailored for growth-focused investors seeking aggressive opportunities and another designed for those with a more defensive approach, prioritizing capital preservation. *For illustrative purposes only.

The US equity market continued to post solid gains in July with the S&P 500 Index reaching new all-time highs, returning 2.4% for the month. Tech and growth stocks led the gains as the “Magnificent 7” rebounded after a pullback earlier in the year due to trade and tariff headlines, and the Nasdaq composite advanced 3.9% for July. We are encouraged by the progress on trade negotiations, the relatively solid Q2 corporate earnings results, and optimism over potential Federal Reserve rate cuts in the second half of the year. Also, a weakening US dollar and pro-business fiscal measures can help to improve business sentiment. While the market is near record highs, we see downward risks in the near term. Uncertainty around the tariff policy could lead to more potential pressure on inflation and a drag on economic growth. Investors are also concerned about weakening consumer consumption and the possibility of delays in monetary easing from the Fed. Furthermore, equity valuations are more stretched after the substantial market gain recently. With this backdrop, we are cautiously optimistic about the US equity market and have increased equity exposure to 69% in our defensive, tailored approach.

What's Driving the Markets?

Tariff Policy Developments: The US equity market has recently digested a slew of tariff news, with partial resolutions such as the trade agreement with EU countries, helping to boost investors’ sentiment. On July 27, President Trump announced that most European imports will be subjected to a 15% tariff, lower than the previously threatened 30% tariff rate. Also, a trade agreement was reached with Japan, which includes a 15% tariff on Japanese imports. On July 29, the US and China concluded another round of trade talks without a final agreement, but officials signaled a possible extension of 90 days after the current “tariff truces” expire on August 12. Although there have been some positive developments in trade negotiations lately, the full effect of tariffs is still unclear. The possibility of additional trade talks or policy changes in August introduces another layer of uncertainty.

Corporate Earnings: As of July 25, among the 34% of S&P 500 companies that have reported Q2 results, 80% have reported a positive EPS surprise, and 80% have reported a positive revenue surprise. The blended YOY earnings growth for the S&P 500 is 6.4%. If 6.4% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q1 2024 (5.8%). Although it is still early in the second-quarter earnings season, initial results from major banks have been positive, with the big banks showing ongoing loan growth and stable deposits, indicating that both consumers and businesses continue to borrow actively. Additional signs of consumer strength can be found in earnings reports from travel and leisure companies such as Carnival Corporation. Meanwhile, the recent passage of the “One Big Beautiful Bill” helped to resolve uncertainty around expiring provisions, providing a modest boost to corporate cash flows and capital spending incentives.

Fed Policy: As anticipated, the Federal Open Market Committee kept the Fed funds rate unchanged at 4.25% to 4.5% in July for the fifth consecutive meeting. Despite the modest increase in inflation, the fast shifts in trade policy and unclear business response to the policies have made it difficult to forecast near-term economic trends. The decision was not unanimous, though. Governor Waller, one of two dissenters, argued for an immediate rate cut, citing weak consumer spending and a lack of inflation momentum. At a post-meeting press conference, Fed Chair Powell explained the decision to maintain the rates, noting that the US economy does not appear to be held back by current monetary policy, as the labor market is basically in balance with slower hiring and immigration-limited labor supply growth. Significant uncertainty around inflation, especially from shifting trade policy, further justified the pause. Firms have initially absorbed tariff costs to avoid price hikes. However, as trade agreements with the EU and Japan now reveal a 15% tariff floor, consumer prices are expected to rise as pre-tariff inventories deplete. Looking ahead, we expect a quarter-point rate cut at the Fed’s September FOMC meeting.

By the Numbers

Valuation

|

Sentiment

|

Technical

|

Macroeconomic

|

As of 7/31/25. Data provided by Bloomberg, NorthCoast Asset Management, Federal Reserve History.

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. and international equity exposure and outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Kovitz can be found at www.kovitz.com.

NorthCoast and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

The information contained herein has been prepared by NorthCoast Asset Management ("NorthCoast") on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2024 NorthCoast Asset Management.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR'S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.

.jpg)