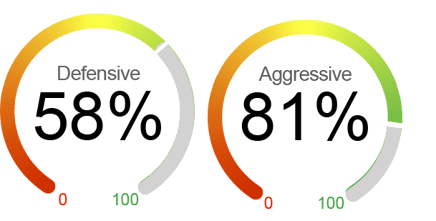

Current Equity Exposure

We employ two distinctive dynamic market exposure models in our strategies: one tailored for growth-focused investors seeking aggressive opportunities and another designed for those with a more defensive approach, prioritizing capital preservation. *For illustrative purposes only.

June 2025 delivered strong U.S, equity performance with the S&P 500 Index and the Dow gaining 5.1% and 4.5%, respectively, while the tech-heavy Nasdaq outperformed by gaining 6.6%. By the end of the month, all three major indices approached their previous record highs, boosted by the de-escalation of the trade war, easing Middle East conflict and optimism around the technology sector. Some of the soft data is recovering on reduced trade risks and the recent market rebound. The University of Michigan consumer sentiment index jumped in June to 60.7 after declining in the previous four months. While the market is near record highs, we see downward risks in the near term. Uncertainty around tariff policy could lead to more potential pressure on inflation and a resultant drag on economic growth. We also expect some weakening in consumer consumption due to the reduction of purchasing power. With the S&P500 trading at 22x forward, valuations remain stretched, which could limit any further equity rally. Furthermore, the underperformance of mid-cap and small-cap stocks year-to-date indicates that market gains remain concentrated, making the market more vulnerable to sector-specific shocks. With this backdrop, we maintain our equity exposure at 58% in our defensive, tailored approach.

What's Driving the Markets?

Fed Policy: As widely anticipated, the Federal Open Market Committee kept the Fed funds rate unchanged at 4.25% to 4.5% in June for the fourth consecutive meeting. The resilient job market has given the Fed the flexibility to adopt a wait-and-see strategy amid the uncertain effects of the new tariffs on inflation and the direction of the economy. The Summary of Economic Projections has projected weaker growth and higher inflation, and unemployment compared with its March estimates. Projections for real GDP were lowered from 1.7% to 1.4% for 2025, while the unemployment rate expectations were increased from 4.4% to 4.5%. Also, the median projection for core PCE inflation has risen to 3.1% from 2.8% in March. While the median dots still indicated a 50-basis-point cut in rates, seven policymakers expect no cuts this year, compared with four members in March. At the same time, although the meeting statement has mentioned that economic outlook uncertainty has "diminished," Chairman Powell had signaled in the press conference that increases in tariffs are "likely to push up prices and weigh on economic activity." Among the Fed's two mandates—full employment and price stability—the policymakers seem to prioritize controlling inflation, given the current resilient labor market and tariff uncertainty.

Inflation: The May CPI (Consumer Price Index) came in softer than expected, with headline CPI inflation rising by 0.1% month-over-month. The core CPI (excluding food and energy) also rose by 0.1%, lower than the consensus estimate of 0.3%. The annual rates for the headline CPI and core CPI were 2.4% and 2.8%, respectively. There is little evidence of the tariff pass-through effect on inflation, with vehicle and apparel prices falling in May. The new tariff policy triggered a surge in vehicle purchases in March and April, followed by a significant decline in sales in May. The price pressure from higher tariffs is mixed, as rising input costs cause higher prices, while weaker consumer demand holds prices down. Inflation expectations fell in May, according to the University of Michigan survey, with one-year inflation expectations plunging from 6.6% to 5.1%, while five-year expectations still hovered around 4.1%. The pause of high tariffs on China was the primary contributor to the drop in one-year expectation.

Geopolitical Risks: The 12-day Israel-Iran conflict ended with a ceasefire brokered by the U.S. that took effect on June 24. Investors were encouraged by the truce and the ceasefire triggered a relief rally, with the tech-heavy Nasdaq 100 surging 1.5% to a record high, while the S&P 500 rose 1.1%. Also, oil prices fell 7% from recent peaks as supply disruptions eased. Despite the initial rally, uncertainty remains regarding how long the ceasefire will last, Iran’s nuclear developments as well as the stability of oil supply. While short-term relief prevails for now, investors should remain cautious, as the risk of renewed conflict remains significant. At the same time, we would like to keep in mind that geopolitical shocks typically result in initial market drops followed by recovery.

By the Numbers

Valuation

|

Sentiment

|

Technical

|

Macroeconomic

|

As of 6/30/25. Data provided by Bloomberg, NorthCoast Asset Management, Federal Reserve History.

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. and international equity exposure and outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Kovitz can be found at www.kovitz.com.

NorthCoast and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

The information contained herein has been prepared by NorthCoast Asset Management ("NorthCoast") on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2024 NorthCoast Asset Management.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR'S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.