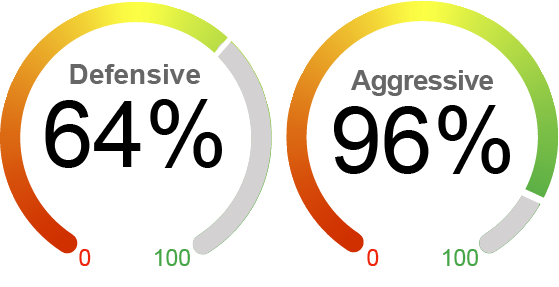

Current Equity Exposure

We employ two distinctive dynamic market exposure models in our strategies: one tailored for growth-focused investors seeking aggressive opportunities and another designed for those with a more defensive approach, prioritizing capital preservation.

The U.S. stock market rallied in November, driven by Presidential election results, another interest rate cut by the Fed, and generally positive third-quarter corporate earnings. The S&P 500 gained 5.9%, and the Nasdaq climbed 6.3% for the month, while the Dow outperformed by rallying 7.7%. Investors expect that the Republican's control of the White House, Senate, and House of Representatives will likely foster stronger corporate earnings growth with fewer regulations and lower corporate taxes. Small caps rallied most after Trump won with improved sentiment and low positioning. Investors are encouraged by resilient economic data, moderating inflation, and broadening earnings growth. The Mag 7's contribution to the S&P 500 returns has dropped from 63% in 2023 to about 47% so far this year. Despite some positive developments, we see risks remain with rich equity valuation, escalating geopolitical tensions and policy uncertainties. For example, while tax cuts could boost corporate earnings, higher tariffs could create a headwind by potentially dragging growth and increasing inflationary pressures, though these effects will probably not become apparent until late 2025. With this backdrop, we are now cautiously optimistic and increased our allocation to US equities in our defensive tailored approach from 59% to 64%.

What's Driving the Markets?

Election: The 2024 US presidential election results have had significant impacts on equity markets, with major equity indexes soaring to record highs post-election, led by the small-cap index, which surged 8.6% for the week. Investors expected that the Republican's control of the White House, Senate, and House of Representatives would likely foster stronger corporate earnings growth with fewer regulations and lower corporate taxes. There are several areas for investors to focus on. First, tax cut: The Trump Administration plans to extend all expiring tax cuts from the Tax Cuts and Jobs Act (TCJA), maintaining a 37% top tax rate. Also, the corporate tax rate for domestic manufacturing could potentially be reduced from 21% to 15%. While the tax cut is expected to increase corporate earnings, it would add significant deficits over the next decade (estimated about $5t). Second, regulations: President-elect Trump has proposed broad deregulation, and financial services and energy companies should benefit most from looser regulations. Third, tariff: The Trump economic agenda emphasizes imposing tariffs on US imports, including a 10% blanket tariff and a 60% tariff on Chinese imports, potentially raising the average rate to 17%. If enacted, the proposed tariffs are estimated to lower the growth of the Western economies by 1% and hit China's GDP by 2% in the first year. However, full implementation is unlikely as Trump has historically modified policies in response to market reactions, and delays are expected due to administrative processes.

Fed’s 25bps rate cut: Following September’s 50 basis points cut, the Fed cut its policy rate by 25 basis points in its November meeting, bringing the Fed funds rate to a range of 4.5% to 4.75%. Chair Powell commented that the Fed sees inflation largely down toward target inflation, and employment is balanced and not a source of inflationary pressure. Also, Chair Powell emphasized the Fed’s independence and that election results would not influence short-term policy. However, he did note that significant potential tariffs could raise inflation while potentially weakening economic growth, complicating the Fed’s policy decisions. Later in the month, Chair Powell tempered expectations by stating that “the economy is not sending any signals that we need to be in a hurry to lower rates.”. According to the futures markets, the probability of a December 25pbs cut decreased from 82% to 58% after the speech. We expect the Fed to maintain a balanced view of inflation and employment risks, with another rate cut likely in December and a slower pace of adjustments in 2025.

Mixed US economic data: The U.S. economy demonstrated some resilience with recent economic and sentiment data. According to the Bureau of Economic Analysis report, Q3 GDP growth came in at 2.8%, with consumer spending contributing most to the robust growth. The NFIB's Small Business Optimism Index increased 2.2 points, reaching 93.7, the highest reading since February 2022. Homebuilder confidence, indicated by the NAHB Housing Market Index, has continued to rise, largely driven by the Fed's easing monetary policy. Also, data released later in the month showed some improvement in sentiment after the election. The top-line business condition index from November's Empire State Manufacturing Survey jumped from -11.9 to 31.2, the highest level since 2021. Despite improving sentiment, the labor market is cooling, with the three-month average of payroll numbers ending in September at 148k (ignoring the October print as it's impacted by the Boeing strike and hurricane activity), significantly lower than last year. Consumer spending has been the most significant contributor to growth, but the household savings rate has dropped to 4.6%, below the historical average.

By the Numbers

Valuation

|

Sentiment

|

Technical

|

Macroeconomic

|

As of 11/30/24. Data provided by Bloomberg, NorthCoast Asset Management, Federal Reserve History.

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. and international equity exposure and outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Kovitz can be found at www.kovitz.com.

NorthCoast and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

The information contained herein has been prepared by NorthCoast Asset Management ("NorthCoast") on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2024 NorthCoast Asset Management.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR'S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.