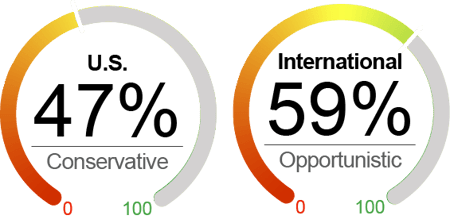

Current Equity Exposure

A market barometer of our current U.S. and international equity outlook

September began with downward pressure on U.S. stocks, but the market regained its footing as investors welcomed the 50-basis point interest rate cut from the Fed. The S&P 500 gained 2.1%, and the Dow climbed 2.0% for the month, while the technology-heavy Nasdaq outperformed by gaining 2.8%. While the FOMC’s medium dot plot calls for another 50-basis points rate cut for the rest of the year, we should be cautious about overstating the actual financial impact, as current Fed rates remain tight compared to a neutral level and the prolonged effect of prior tightening is still working its way through the economy. In our view, the equity market’s response to potential further cuts will largely depend on the upcoming economic data. If the activity data shows weakness in the coming months, especially if the labor markets soften, the Fed may be perceived as being behind the curve. Also, the approaching November presidential election may introduce further volatility to the equity market. At the overall market level, we believe that risk-reward for the equity markets is still challenging in the near term, on weakening activity momentum, the timing of Fed policy, rich equity valuation, and election and geopolitical uncertainty. With this backdrop, we slightly increased our allocation to U.S. equities but maintained a conservative level of 47% and our international equity exposure at 59%.

What's Driving the Markets?

Fed’s 50bps rate cut: For the first time since the COVID-19 pandemic, the Fed cut its policy rate by 50 basis points at its September 2024 meeting, lowering the Fed funds rate to a range between 4.75% and 5%. This decision was primarily driven by signs of moderating inflation and recent weakening payroll data. As to the concerns about whether the Fed was “behind the curve,” Chairman Powell addressed that the FOMC believes that the U.S. economy “is strong overall,” and he does not see, “anything in the economy right now that suggests that the likelihood of a downturn is elevated.” The initial reaction to the Fed’s decision was muted, with the S&P 500 Index falling slightly on the Fed’s decision day. However, the major equity indexes surged to record highs on the second day as investors digested and celebrated the big rate cut. We now project 25bps cuts at the Fed’s November and December meetings, thus leading to a 1% lower Fed funds rate by the end of this year.

Moderating Inflation: Inflation moderated again in August, with the headline CPI increasing 0.2% from July, resulting in a decrease in the year-over-year inflation rate from 2.9% to 2.5%, the lowest level since March 2021. Core CPI (excluding food and energy) rose 0.3% in August, with year-over-year growth remaining at 3.2%. The modest upside surprise in core CPI was primarily driven by an acceleration in shelter inflation (a 0.5% rise), though the owners' equivalent rent (OER) doesn't reflect actual costs households incur. Other major components of CPI, including food inflation, new vehicles, and used vehicles, remained subdued. Moreover, the Fed's preferred measure of inflation, the core Personal Consumption Expenditures (PCE) index, rose 0.1% in August, in line with expectation, with the annual rate ticking up from 2.6% in July to 2.7% in August.

Mixed Economic Data: Recent economic data has showed some resilience in the U.S. economy, though there are expectations of a gradual slowdown. The labor market is cooling, with payrolls rising by only 142,000 in August, which was weaker than expected, though it was a slight improvement from July. Moreover, the previous two months' job growth figures were revised down significantly by 86,000 combined. The manufacturing sector is contracting, as evidenced by the ISM Manufacturing Index remaining below the 50 neutral level at 47.2. The housing market continued to struggle despite slightly lower mortgage rates, with existing home sales falling in August by 2.5% to a seasonally adjusted annual rate of 3.86 million. On the positive side, U.S. consumers continued to demonstrate resilience. Consumer spending (in real terms) remains robust, with its third straight month of healthy growth of 0.4%, but the saving rate dipped to 2.9%, raising concerns about sustainability. Although retail sales only grew by 0.1% in August, a noticeable slowdown from July, total sales year-over-year increased by 2.1%, slightly higher than expected.

By the Numbers

Valuation

|

Sentiment

|

Technical

|

Macroeconomic

|

As of 9/30/24. Data provided by Bloomberg, NorthCoast Asset Management, Federal Reserve History.

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. and international equity exposure and outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Kovitz can be found at www.kovitz.com.

NorthCoast and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

The information contained herein has been prepared by NorthCoast Asset Management ("NorthCoast") on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2024 NorthCoast Asset Management.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR'S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.