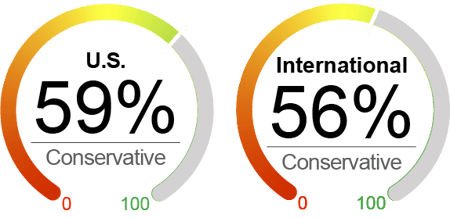

Current Equity Exposure

A market barometer of our current U.S. and international equity outlook

October started with some upward momentum pressure on U.S. stocks, but the market lost its footing as investors contemplate the imminent election uncertainty. The S&P 500 lost 0.93%, and the Dow lost 1.26% for the month, while the technology-heavy Nasdaq outperformed by losing 0.82%. While the FOMC’s medium dot plot calls for another 50-basis points rate cut for the rest of the year, we should be cautious about overstating the actual financial impact, as current Fed rates remain tight compared to a neutral level and the prolonged effect of prior tightening is still working its way through the economy. In our view, the equity market’s response to potential further cuts will largely depend on the upcoming economic data. If the activity data shows weakness in the coming months, especially if the labor markets soften, the Fed may be perceived as behind the curve. Also, the approaching November presidential election may introduce further volatility to the equity market. At the overall market level, we believe that risk-reward for equity market is still challenging in the near term, on weakening activity momentum, timing of Fed policy, rich equity valuation, and election and geopolitical uncertainty. With this backdrop, we slightly increased our allocation to U.S. equities but maintained a conservative level of 59% and our international equity exposure at 56%.

What's Driving the Markets?

Inflation: The September CPI (Consumer Price Index) came in hotter than expected. The headline CPI increased by 0.2% from August, higher than consensus expectation, with a year-over-year inflation rate of 2.4%. More importantly, the core CPI (excluding food and energy) rose 0.3% in August, with year-over-year growth ticking up from 3.2% to 3.3%. Unlike August’s CPI, which was primarily driven by shelter inflation, September’s hotter-than-expected inflation was mainly due to food inflation and a diminishing benefit from the decline in goods prices. Food prices grew by 0.4%, the largest monthly rise in 2024. Although food inflation is only about 2% of CPI, it has a relatively significant impact on consumer sentiment. At the same time, core goods prices rose for the second time in 16 months, with new and used vehicle prices ticking up in September. The hotter-than-expectation inflation data, together with September’s strong payroll report, may imply a more cautious approach for the Fed to cut interest rates. Our baseline prediction remains a 25-basis point rate cut at both the Fed’s November and December meetings.

Election: The U.S. election landscape is coming into focus as election day approaching. With Vice President Harris and former President Trump locked in a tight contest, investors are closely monitoring polls and economic indicators for potential clues about the election outcome. Markets are particularly focused on potential policy changes in areas including taxes, tariffs, regulation, and immigration. For example, While Harris’s tax policy largely aligns with Biden's plan, Trump aims to extend the Tax Cuts and Jobs Act and implement new cuts for corporate taxes. Regarding energy policies, Harris is likely to continue current clean energy policies while Trump administration would focus more on boosting traditional energy production. Regulatory approaches differ significantly, with Trump potentially pursuing deregulation, especially in banking, while Harris might reshape healthcare through expanded Medicare or drug price caps. However, it's important to note that while elections typically create short-term market fluctuations, our research based on empirical data shows that the equity market has on average performed slightly better one month following the election day. We are closely monitoring the developments but believe that investors should be cautious to attempt to position their portfolios by hedging against either party’s victory, as elections results are usually highly uncertain and difficult to predict.

U.S. and Global Economy: The global economy in October 2024 showed signs of a gentle deceleration, with the U.S. experiencing a significant slowdown in job growth. The U.S., economy added only 12,000 jobs in October, falling well short of economists' expectations of 113,000. This disappointing jobs report suggests a cooling labor market, although the unemployment rate remained steady at 4.1%. The Federal Reserve's decision to cut interest rates by 50 basis points in September appears to have been prescient, as economic data now indicates a softer landing than initially anticipated or no landing at all. Consumer spending remained resilient but increasingly prudent, with a bifurcated outlook between lower-income and higher-income households. Global economic concerns persisted, particularly evident in the oil market, where Brent Crude prices had fallen by 17% in the previous quarter. Despite these challenges, the third quarter of 2024 ended with healthy returns across most major asset classes, setting a cautiously optimistic tone for the final months of the year.

By the Numbers

Valuation

|

Sentiment

|

Technical

|

Macroeconomic

|

As of 10/31/24. Data provided by Bloomberg, NorthCoast Asset Management, Federal Reserve History.

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. and international equity exposure and outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Kovitz can be found at www.kovitz.com.

NorthCoast and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

The information contained herein has been prepared by NorthCoast Asset Management ("NorthCoast") on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2024 NorthCoast Asset Management.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR'S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.