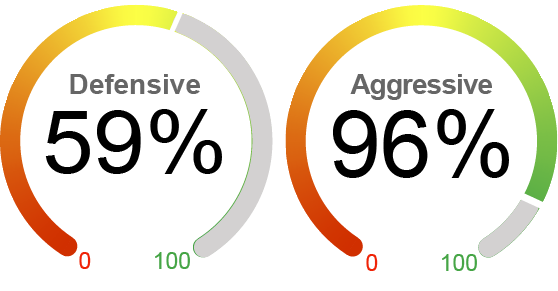

Current Equity Exposure

We employ two distinctive dynamic market exposure models in our strategies: one tailored for growth-focused investors seeking aggressive opportunities and another designed for those with a more defensive approach, prioritizing capital preservation.

2024 has ended with mixed results in the final month of the year. In December, the S&P 500 Index declined by 2.4%, and the Dow Jones dropped by 5.1%. However, the Nasdaq 100 Index, primarily comprised of companies in the technology sector, ended the month with a mild 0.5% gain. The broad declines began around the FOMC’s December meeting, where it projected a more cautious approach to rate cuts in 2025. A Santa Claus rally helped pare back most of the index losses, but the decline resumed toward the end of the year. Despite the December pullbacks, 2024 concluded with positive results: the S&P 500 posted a 24.3% gain for the year, the Dow Jones rose by 14.9%, and the Nasdaq 100 saw a 25.7% gain. Economic data remains resilient, with moderating inflation and broadening earnings growth, along with expectations of fewer regulations and lower corporate tax rates under Republican control. However, risks such as high equity valuations, geopolitical tensions, and policy and trade uncertainties persist. We remain cautiously optimistic and have pared back our allocation to U.S. equities in our defensive tailored approach from 64% to 59%.

What's Driving the Markets?

A more cautious Fed: At its December meeting, the FOMC cut its policy rate by 25 basis points, bringing the Fed funds rate to a range of 4.25% to 4.5%. While the cut was largely expected, the FOMC’s latest Summary of Economic Projections indicated a more cautious approach to policy easing in the coming year. The median committee member now expects only 50 basis points in rate cuts for 2025, down from the 100 basis points projected in its September meeting. The estimate of the neutral interest rate has also increased, with the median long-run rate expectation now at 3%, compared with 2.9% in September and 2.5% in December 2023. At the same time, with the recent inflation proved to be stickier, FOMC’s inflation projections have been revised upward: the median forecast for the PCE deflator by the end of 2025 increased from 2.1% to 2.5%. The Fed’s more cautious stance than expected led to a negative market reaction, with the S&P 500 Index falling almost 3% on the announcement day.

Inflation concerns: The November CPI (Consumer Price Index) came in a bit stickier than expected but remains on a general trajectory of moderation. Both the headline CPI and core CPI (excluding food and energy) increased by 0.3% from October. On a year-over-year basis, headline CPI edged up from 2.6% to 2.7%, while core CPI held steady at 3.3% for three consecutive months. Although both grocery and vehicle prices edged higher, the encouraging news is that shelter inflation, a key component of CPI, slowed significantly, with owners’ equivalent rent rising only 0.2%, its smallest increase since early 2021. Meanwhile, producer prices increased more than anticipated, with PPI for final demand rising 0.4%, pushing the annual rate up from 2.6% to 3%, the highest level in about two years. The higher-than-expected PPI number might lead to potential upward pressure on consumer prices in the near future. Additionally, the core PCE inflation, a key inflation measure, remained at 2.8% in November, higher than six months earlier, prompting the Fed to revise its 2025 inflation forecast upward to 2.5%.

China’s stimulus policy: During the Politburo's policy meeting, China's leaders committed to implementing "more proactive" fiscal policies and "moderately" easing monetary policy next year in order to stimulate domestic consumption and stabilize the property markets. Also, the 2024 China Central Economic Work Conference (CEWC) outlined nine key strategies for addressing economic challenges in 2025, including boosting domestic demand and investment efficiency. The government also laid out plans to expand fiscal spending, raise the fiscal deficit ceiling, and reduce reserve requirements and interest rates. The Chinese equity market responded positively to the stimulus announcement, with the CSI 300 Index increasing 2.5% from December 4 to December 12. Despite the good news, challenges persist, including a housing downturn with property investment falling 10.4% from January to November. Retail sales grew less than expected, reflecting Chinese consumers' reluctance to spend. Investors are also concerned about a potential escalation in trade tensions between China and the U.S.

By the Numbers

Valuation

|

Sentiment

|

Technical

|

Macroeconomic

|

As of 12/31/24. Data provided by Bloomberg, NorthCoast Asset Management, Federal Reserve History.

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. and international equity exposure and outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Kovitz can be found at www.kovitz.com.

NorthCoast and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

The information contained herein has been prepared by NorthCoast Asset Management ("NorthCoast") on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2024 NorthCoast Asset Management.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR'S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.